Compensation Philosophy and Structure

Our Compensation Philosophy

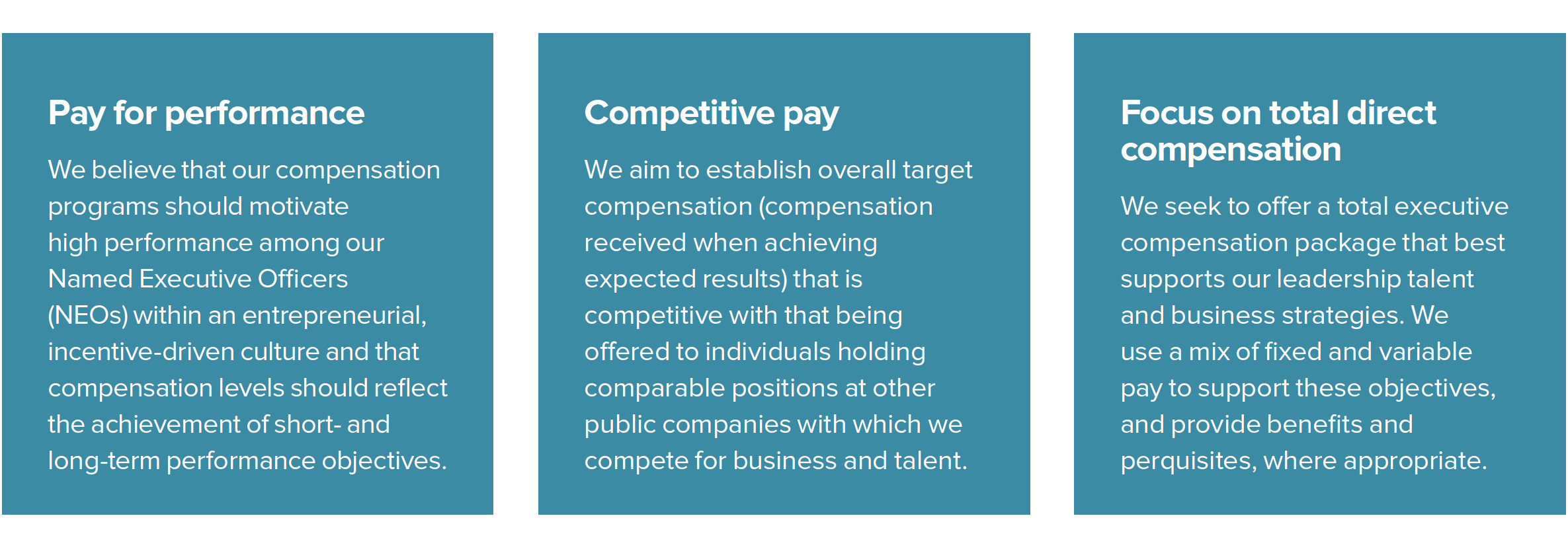

Our ability to compete effectively depends to a large extent on our success in identifying, recruiting, developing and retaining management talent. To this end, the design of our executive compensation program and the decisions made by the Compensation Committee of the Board are guided by the following principles:

Hologic is focused on growth, efficient use of capital and shareholder value. Consequently, the Company uses measures of adjusted revenue, adjusted EPS, ROIC (return on invested capital), free cash flow, and relative TSR (total shareholder return) for incentive compensation plans. We believe this compensation structure drives performance, while also ensuring management efforts are aligned with the interests of our shareholders.

ROIC

The Compensation Committee introduced ROIC as a performance metric in fiscal 2014 to hold management accountable for generating greater returns on capital allocated. This metric:

• Creates an effective balance of growth and returns.

• Holds management accountable for the efficient use of capital.

• Links executive compensation to value creation.

ADJUSTED FREE CASH FLOW

In fiscal 2020, the Compensation Committee added the measure of free cash flow, which is an important metric as the Company seeks to continue to deploy capital efficiently with continued business development activity and share repurchases.

RELATIVE TSR

In addition to being well-received and supported by our stockholders, use of relative TSR:

• Provides an external performance measure, which complements the internal ROIC measure.

• Links executive compensation directly to stockholder value creation.

Executive Stock Ownership

Our Board believes that our directors and officers should hold a meaningful financial stake in the Company in order to further align their interests with those of our stockholders. Our CEO is expected to achieve equity ownership in the Company with a value of five times his then-current base salary. Each of our other Named Executive Officers (NEOs) and executive officers is expected to achieve equity ownership in the Company with a value of two times his or her then-current base salary.

As of the end of fiscal 2020, Mr. MacMillan owned equity in the Company with a value of over 81 times his fiscal 2020 base salary, making him one of our 30 largest stockholders. Mr. MacMillan purchased over 17% of these shares in the open market. As evidenced by his substantial ownership of Hologic shares, Mr. MacMillan’s interests are well-aligned with those of stockholders.